A study by the National Infrastructure Commission (NIC), published on Tuesday 18 October, estimates in its advice to government that if the UK is to hit its 2050 target for achieving ‘Net Zero’, taxpayers will have to find roughly double the amount of money the nation would have had to spend on renewing and updating energy and transport infrastructure over the next 27 years to £2 trillion, the additional £1 trillion to be spent on the implementing the green agenda.

A trillion, its easy to say but is an unimaginably big amount of money to find. A good illustration of how big is to imagine spending a pound a second every single second, no weekends, no holidays, no time off for good behaviour, for the next 31,709 years and 10 months (and yes, I did use a computers to work that out.)

31,710 years ago our ancestors, though they had moved on from the knuckle dragging phase of human evolution, were, as far as we know, still living in caves, eating raw meat and running around naked.

A trillion is a conservative estimate of course. Given that the UK national debt is increasing at roughly one million pounds every three and a half minutes and that our spending on health and welfare, energy, roads and railways, education, defence, environment etc. etc. is not likely to go down that estimated cost of Net Zero is likely to increase exponentially in the way government projects always do and end up having cost not two trillion but 22 trillion in 27 years time.

So unless government suddenly comes to its senses and realises that unless we want to return to living in caves, eating raw meat and running around naked we had better abandon ‘net zero’ unless it plans to reduce unemployment by hiring gangs of muscular people to shovel money into firey furnaces (thus causing lots of CO2 to be emitted.) Most of the (estimated) extra trillion would go on replacing petrol cars with electric ones and gas boilers with electric heat pumps, and on generating, transmitting and distributing the extra electricity needed for these two uses. It also includes a host of other capital projects, including better household insulation. With all that electric demand, we would need extra power stations, extra pylons and upgrades of household electrical circuits. And we would need subsidies for installing the heat pumps and buying electric vehicles. And if anyone thinks that lot could be done for a paltry one trillion, that person is probably working as a senior economic adviser for the treasury department.

According to the assessment £74 billion would have to be spent on closing down and decommissioning the gas network: the National Infrastructure Commission (NIC), which was set up to promote economic growth, has been so totally hijacked by the bansturbators of the green lobby that it is now a National Dismantling Commission.

With the exception of home insulation, very little of that £1 trillion would actually improve your lifestyle in any practical way. It does not promise to give you cheaper or more reliable electricity in fact wind and solar are proving more expensive and less reliable. It would not save you any money or give you any more spare time — or make you more productive.

It would generally replace smaller things with bigger things — more pylons, heavier cars, bigger radiators, wind farms occupying hundreds of acres of good land instead of gas turbine power stations occupying five acres — so it would actually clutter the world more.

Facts and arguments aren’t going to change the minds of Net Zero advocates of course. What will change their minds is the sense that those of us who do not enjoy the inflated salaries and inflation linked pensions of public sector workers, and therefore are opposed to all this Net Zero, save the planet bollocks (not of which is backed by scientific evidence, all the green lobby have is output from mathematical models,) and are getting angry. The fearmongering tactics favoured by the elite has failed as realisation grows that all these virtue signalling policies so beloved of the elite are going to impoverish us and push us back to the kind of living standards endured by working people in the nineteenth century and might just pick up out pitchforks and cudgels (metaphorical ones of course, we can do much more damage with a couple of household cleaning products and a cheap burner phone,) and going after Net Zero zealots, their energy efficient homes and their beloved pimped up and highly combustible golf trolleys.

They need to feel the need to abandon quasi – religious ideology at an emotional level and face mundane reality. And as we all know, because the elites, the wannabe overlords, taught us, fear is best weapon for changing minds.

RELATED:Germany Burns Net Zero Pledges And Fires Up Coal Generating Plants Ahead Of Winter Peak Electricity Season

On Wednesday this week Germany’s coalition government approved putting coal power plants back online until the end of March 2024 to ensure energy security when natural gas supplies cannot meet demand. Though Germany has for at least a decade vied with Britain to claim leadership of Europe’s ill – advised push for net zero, the Berlin government has been forced into this move

Is Hatred Of Greta Thunberg Justified?

As the backlash against the Greta Thunberg cult gathers momentum a lot of lefties are asking why the little Climate Warriorette is so hated by so many people. As usual with the left, they are asking the wrong question. Just as they asked, “Why can’t you believe the scientists, when in fact not only is it always legitimate (and scientific,) to question and challenge scientific theory, so it is perfectly rational and logical to challenge the Cult of Saint Greta ….

The Offshore Wind Fiasco Sets New Records For Government Incompetence

In an article on wind powered generators last week a science & technology writer showed himself in need of remedial education in basic literacy:”Meanwhile, 14GW of installed capacity puts us second in the world behind China,” he burbled

The problem here is inability to understand the meaning of ‘installed capacity.’ If it means a capability of generating 14GW of electricity, as it would if we were discussing gas, nuclear or coal that would be lovely …

Millions Of Brits Told Not To Heat Homes At Night As Part Of ‘Net Zero’ Push

No, they aren’t urging elites to ditch their private jets for commercial, or not to burn 1,000 of fuel taking the yacht out for a jaunt. Chris Stark, head of the UK’s Climate Change Committee, wants ordinary citizens to turn off their electric heaters (heat pumps) at night as part of a wider drive to deliver “emissions savings,” which includes a shift away from gas boilers – which Chris, a hypocrite, still has.

Debunked: The Great Renewable Green Delusion

The war in Ukraine has not caused the global energy crisis of early 2022 byt merely exacerbated it. Currently the nations currently in conflict with Russia over its incursion into Ukraine are those which are most dependent for their energy needs on Russian oil and gas. And now their loonytoons ‘net zero’ green energy policies have failed they are biting the hand that feeds them.

Has The Green Blob’s War On Fossil Fuels Been Lost On The Battlefields Of Ukraine

With some energy sector opinion makers already pronouncing the ‘net zero’ agenda is already dead as oil and gas supplies from Russia dry up due to NATO / EU sanctions and Moscow’s retaliatory export bans which have only been in force a week at the most, governments in the liberal democracies of Europe and North America are already talking about starting up redundant coal and nuclear power stations, the UK, Netherlands and other nations with offshore gas operations in the North Sea are suddenly finding that it may now be economically viable to start pumping again and (whisper it ever so quietly,) coal is coming back into the reckoning as an energy source …

Extinction Rebellion Wants To Destroy Civilization, Not Just Fossil Fuels

Readers may find it hard to believe but while our attention has been focused on the coronavirus pandemic, other things have been happening. Recently the eco – crusties of EkSTIMKtion Rebellion have elbowed their way back into out consciousness and now, with Antifa and Black Lives Matter, form an unholy trinity of Marxist seditionist groups intent not only on destroying capitalism but destroying civilisation …

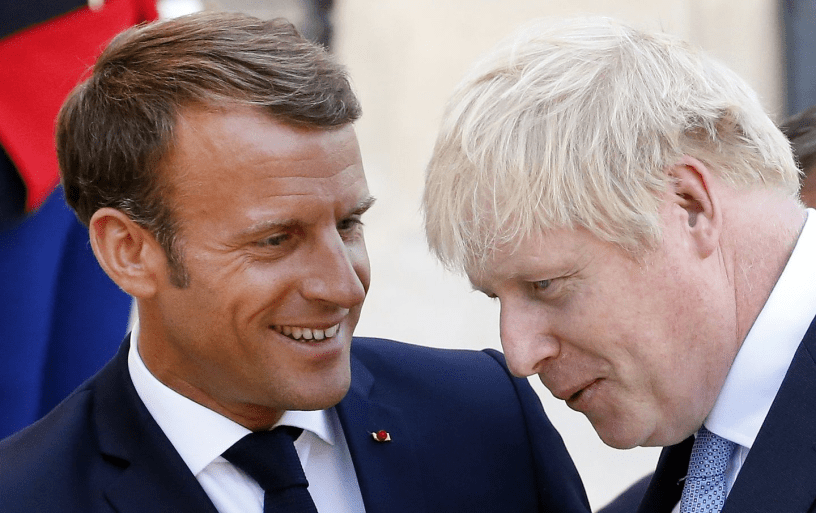

We Told You So – Government-funded Report Confirms World’s Largest offshore Wind Farm is UnprofitableA report commissioned by the Norwegian government has contradicted Boris Johnson’s recent claim that offshore wind costs have fallen by 70% in a decade. The report also blows a huge hole in Johnson’s grandiose pledges to the COP26 conference that offshore wind power would propel Britain to its net – zero target for Carbon Dioxide emissions well before 2050, the target set by the climate conference for achieving that target.

RELATED:

COP26 Climate Conference – Just Another Elitist Scam To Steal Your Money

If you are one of the people who still relies on mainstream media for information, the ‘on – message’ news reports coming from the COP26 Climate Conference in Glasgow this week, and during the build up to the conference, might have convinced you that the entire world (barring a few crazy conspiacy theorists,) is signed up to the ‘net zero’ agenda and believes that destroying the economies of the developed nations while exporting our jobs, business and prosperity to places like India and China is the only way to save the planet.

Continue reading >>>

Green dreams of Heat Pumps

Continue reading >>>

When Boris Johnson revealed the UK Government plans for achieving ‘net zero’ carbon emissions by 2050 it emerged the much teased clean, green replacement for gas boilers as our main source of domestic heating is to be heat pumps. The Daily Stirrer counters the pseudo-scientific bollocks and reveals this ‘new technology has been around for a hundred years.

Worst polluting coal and wood fires banned in fight to cut emissions

Domestic coal and certain types of wood are to be banned from sale from next year in a bid to cut air pollution, ministers will announce on Friday.

Climate change: Electrical industry’s ‘dirty secret’ boosts warming

Another Setback For UK’s Net Zero Green Dreams As Cost Rise Faster Than China’s CO2 Emissions

The UK ruling elite’s dreams suffered another setback today when Swedish energy company Vattenfall announced work on the Norfolk Boreas offshore wind farm is to be suspended. The reasons given are spiralling costs, uncertainty in supply lines and the economic reality that offshore wind farms are hideously expensive to operate as well as being enormously damaging to the marine environment.

Out Of Touch Elites Are Destroying Civilised Society Society With Net Zero Obsession And No Plan B

How good it must have felt for politicians to set those lofty goals, knowing that someone else must deal with the cost and the implementation? But now the bills are now arriving, and they’re bringing a world of hurt. To sum up: Western policy elites have embarked on the electrification of society, replacing hydrocarbons in housing and transport, but without the technology to replace it well.

Net Zero Will Lead To The End Of Modern Civilisation, Says Top Scientist

In a recently published science paper, Dr. Wallace Manheimer said Net Zero would be the end of modern civilisation. Writing about wind and solar power he argued it would be especially tragic “when not only will this new infrastructure fail, but will cost trillions, trash large portions of the environment, and be entirely unnecessary”.

Just When We Need It Most, Renewable Energy Disappears

In an encouraging sign of a great awakening, million of people in the UK are now, after a week of brutally cold, absolutely windless weather asking “Why have we wasted so much money on wind turbines and harvesting solar energy.”

Yet when politicians are asked directly: “How do we keep the lights on and our homes warm when the wind does not blow and the sun is too low in the sky to make much impression on photovoltaic cells that do the business in solar panels?

Europe’s Cold Spell Exposes Green Energy Policy Failure

So far the autumn of 2022 has been unusually mild which has had eco-warriors getting worked up and gluing their arses to motorways and airport runways to demand that we stop using oil. However winter temperatures across Europe predictably dropped sharply in late November and through most of December to date have been positively arctic. Scientists have offered the opinion that the cold weather spell the ongoing European gas crisis is now “likely” to worsen significantly as usual seasonal weather spreads across the northern half of the continent, bringing with it an increased need for domestic heating.

The True Cost Of The Green Energy Boom Is Now Being Realized

For four decades we have been fed a constant stream of propaganda assuring us that green energy was the only way forward if we wanted to secure supplies of the energy essential to a modern society while preventing the environmental catastrophes that would be the inevitable consequence of climate change caused by the Carbon Dioxide (CO2) emitted by human industrial, commercial and social activity. … Continue reading >>>

Is the EU planning to pick a fight with the olive oil business

Is the EU planning to pick a fight with the olive oil business