Much discussion in UK media and as far away as The USA and Australia this week has focued on the decision by Coutts (the posh people’s bank,) to ‘de-bank’ former UKIP leader Nigel Farage, the political outsider who successfully steered the campaign to take Britain out of the EU to victory in a national referendum. According to Coutts initial responses to media attention the decision was taken because of reputational concerns.

Bizarrely, when Farage, now host of a popular radio talk show, took his story to the media Coutts told the BBC

that the Farage account closure was due to financial requirements. This was probably was one of the

worst corporate cock ups in recent history because it was so easily falsifiable, especially for a skilled operator like Farage whose track record shows he knows how to use the media. After after days of media

fury about a corporate war on free speech, stirred up mostly by the former Ukip leader himself, and a genuine public outcry because in this era of automation, digitization and depersonalisation, banking is an essential service and if it can happen to Nigel Farage because his bank don’t like some of his opinions, it can happen to any of us.

Coutts have now caved in following criticism from everybody from Prime Minister Rishi Sunak to Stan the bloke in the pub who has an opinion about everything, the bank and its parent company Nat West group have issued a grovelling apology to Farage for comments made about him during a meeting of the bank’s wealth reputational risk committee.

Alison Ross, the chief executive of NatWest this afternoon released a lengthy apology for the ‘deeply inappropriate comments made in the now published papers. They ‘do not reflect the views of the bank’, she said, adding ‘I believe very strongly that freedom of expression and access to banking are fundamental to our society and it is absolutely not our policy to exit a customer on the basis of legally held political and personal views.’ The bank has now offered ‘alternative banking arrangements’ at NatWest.

As mentioned above banking is an essential service in the modern and increasingly cashless world. To deny anyone access to banking facilities is tantamount to erasing their social existence, hamstringing their ability to earn a living or but essential goods and services and ultimately eliminating them from society. Withdrawing banking facilities in a way which would inhibit that person’s ability to make alternative arrangements without acceptable reasons is an intolerable injustice.

This practice is akin to isolating someone, no matter how ill, from access to health services because his/her legitimately stated/held views do not confirm to the ‘diversity, inclusion and equality’ [DIE] narrative promoted by political, media and business establishment organisations. Such cancellation represents a gross violation of that person’s inalienable rights to free speech and personal liberty the fundamental destruction of a basic human right to access an essential service without which normal existence is rendered impossible.

The most alarming thing of all is that leaders of powerful corporate organisations, not to mention public services managers, can so easily terminate individuals’ bank accounts (or access to services) with little or no accountability.

We associate such tyranny with regimes Nazi Germany, communist Russia, modern

China, North Korea or certain Middle Eastern theocracies. The large dossier compiled by Coutts on

Nigel Farage without his knowledge is a most sinister development of a

kind that we thought was confined to brutal totalitarian police states,

not the so-called liberal democracies.

RELATED:

Just Another Day In Bizarro World: Colonel Forced Out Of TheArmy For Saying ‘Men Cannot Be Women’

Dr Kelvin Wright, 54, had been a Reservist commanding officer with 14 years’ unblemished service, including two tours in Afghanistan, before his “honour was attacked” with a transphobia complaint and an investigation he described as “hellish”. In May, he shared a post on his private Facebook account from Fair Play for Women, a group that works to preserve women’s sport for those born female,

Scientists say gruesome cigarette-style warnings on MEAT could be used to shame buyers

Images of black lungs and rotting teeth cigarette packets were intended designed to put smokers off but in fact it is punitive taxes that reduced the prevelance of tobacco smoking. The scare tactics were not 100% effective but they did enough to suggest that that slapping similar stickers on packs of meat in supermarkets could shame buyers into accepting a diet of mashed bugs and plant based gunge like Quorn and Tofu.

UK Conservative MP Claims Cover Up Of Covid Vaccine Related Heart Problems By Big Pharma & Research Organisations

UK Conservative Member of Parliament Andrew Bridgen, who has made highly public, ‘off message’ criticisms of the media silence about the harms causede by COVID 19 mRNA vaccines, has now urged the government and British National Health Service to discontinue use of the vaccines as they clearly do not either prevent infection or alleviate symptoms but have so far been linked to far more cases of serious adverse reactions that all other vaccines introduced over the past thirty years.

World Eeconomic Forum Fuhrer Klaus Schwab Says Governments Must Harness A.I. And They Will Be ‘Masters of the World’, MWAH HA HA HARRR

Addressing the World Government Summit in Dubai,World Economic Forum Chairman and Scooby Doo Villain lookalike Klaus Schwab said that emerging technologies such as Artificial Intelligence which will usher in a ‘Fourth Industrial Revolution’ can become “masters of the world,”

Digital Authoritarianism: AI Surveillance Signals The Death Of Privacy

New advances in AI surveilance techniques threaten privacy, civl rights and free speech.

The Great Genocide: Dutch Govt Plans to Shut Down Up To 3,000 Farms To Comply With Euronazi Union Green Law

As we reported earlier in the year, in order to comply with new, economically suicidal European Union environmental laws the Dutch government’s plans to force the closure of thousands of dairy and livestock farms in order to comply with the latest and most insane to date batch of EU environment laws which aim to limit notrogen as well as Carbon Dioxide emissions. The European Union green agenda directive has been branded as the “Great Reset turned up to eleven”.

Politicians Are Offering A Trade, Safety For Freedom. But What Are We Really Trading Away?

It’s the age old confidence trick, politicians and the elites offter a straight choice between security of freedom and all the risks it entails, then amplify those risks with scaremongering propaganda. In the case of the COVID crisis it has worked so far, with enough people accepting the need for masks, lockdowns and killer vaccines to make The Great Reset seem feasible – but time is running out and people are waking up …

Big Tech tyranny is the biggest threat to democracy in our era

This weeks main story, pushing Coronavirus aside at last, has been the attempt by Twitter to censor U.S. President, classifying his somewhat rabid tweets as misinformation. Whether you love or hate Trump or any other occupant of The White House, their utterings can never be dismissed as ‘misinformation’ because they represent what one of the most powerful people in the world is thinking.

Politicians Are Offering A Trade, Safety For Freedom. But What Are We Really Trading Away?

It’s the age old confidence trick, politicians and the elites offter a straight choice between security of freedom and all the risks it entails, then amplify those risks with scaremongering propaganda. In the case of the COVID crisis it has worked so far, with enough people accepting the need for masks, lockdowns and killer vaccines to make The Great Reset seem feasible – but time is running out and people are waking up …

Big Tech tyranny is the biggest threat to democracy in our era

This weeks main story, pushing Coronavirus aside at last, has been the attempt by Twitter to censor U.S. President, classifying his somewhat rabid tweets as misinformation. Whether you love or hate Trump or any other occupant of The White House, their utterings can never be dismissed as ‘misinformation’ because they represent what one of the most powerful people in the world is thinking.

University free speech society told free speech a ‘red risk’, external speakers must be vetted

Sheffield University’s recently formed Free Speech Society has been warned that free speech is a “red risk” and all external speakers at events it organises will have to be vetted by the University Thought Police squad and the topics they intend to talk about shown to be in line with ideas and opinions the titty – sucking babies who run the Student Union are not frightened by.

Big Tech tyranny is the biggest threat to democracy in our era

This weeks main story, pushing Coronavirus aside at last, has been the attempt by Twitter to censor U.S. President, classifying his somewhat rabid tweets as misinformation. Whether you love or hate Trump or any other occupant of The White House, their utterings can never be dismissed as ‘misinformation’ because they represent what one of the most powerful people in the world is thinking.

French Intellectual Jailed for Calling Mass Immigration an “Invasion”

French intellectual Renaud Camus (above) has been conditionally sentenced to 2 months imprisonment for arguing that mass immigration in Europe represents an “invasion.” Summit.news reports: The writer, who is the author of Le Grand Remplacement (The Great Replacement), was charged with “public incitement to hate or violence on the basis of origin, ethnicity, nationality, race or religion.”

There Is No Freedom Without Transparency

The Democrat / Republican political puppets in the USA would be supported by European leaders including Prime Minister David Cameron in the UK, France’s Francois Hollande and Germany’s Angela Merkel who, even as I type, are preparing massive interventions in Libya and Iraq, both turned into chaotic and lawless failed states by previous US / European interventionsThere Is No Freedom Without Transparency

Facebook Declares War On Free Speech

Facebook has for some time had a policy of removing text that the majority of people would consider racist. Now the social media site is now deleting and blocking comments that only one person at Facebook decides is “racist.” The sinister, Orwellian reality of a society in which the expression of majority opinion is being turned into a crime has already been witnessed across Europe. Even more disturbing, social media operators such as Facebook and Twitter appear to be collaborating with governments in the suppression of free speech.

Facebook Declares War On Free Speech

The Great Genocide: Dutch Govt Plans to Shut Down Up To 3,000 Farms To Comply With Euronazi Union Green Law

As we reported earlier in the year, in order to comply with new, economically suicidal European Union environmental laws the Dutch government’s plans to force the closure of thousands of dairy and livestock farms in order to comply with the latest and most insane to date batch of EU environment laws which aim to limit notrogen as well as Carbon Dioxide emissions. The European Union green agenda directive has been branded as the “Great Reset turned up to eleven”.

Despite the fact that they represent only the interests of big business, big finance and themselves, the oligarchs of the World Economic Forum are now calling for a policy of merging human and artificial intelligence systems so that computer chips implanted in our brain can edit and censor “hate speech” and “misinformation” online before it is articulated trough spoken of written word online.

We The Good Guys Versus They The Bad Guys Reporting Does Not Make Sense For The Ukraine Crisis

Mainstream media reporting of the conflict in Ukraine has disappointed. Perhaps I was naive to suppose that lessons might have been learned from the hits their print sales and online traffic rates took as a result of their handling the COVID pandemic But instead of focusing on the most obviously newsworthy aspect of the build up to and escalation of the war, Russia’s view of NATO expansion into Ukraine and even further to Georgia and Kazakhstan, news reports have simply demonised Russia and portrayed Ukraine as the good guys.

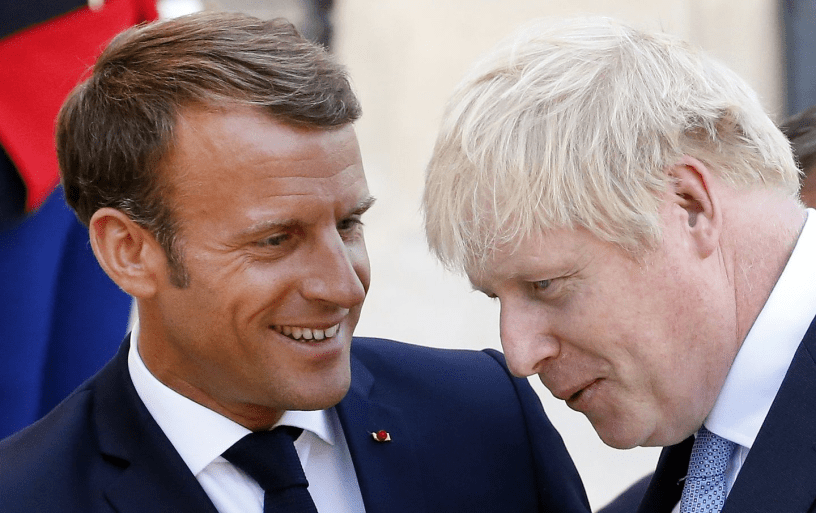

French Police Use Teargas As Freedom Convoy Brings Thousands Of Protestors To Paris

Inspired by Canada’s freedom Convoy, a sponaneous protest by drivers of heavy trucks against the fasistic and oppressive curtailment of individual freedoms by Prime Minister Trudeau’s regime, French truck drivers protesting President Macron’s similarly authoritarian measures converged on Paris where they were met by riot police enforcing Macron’s ban on protests against government policy …

Negative Interest Rates & The War On Cash, Part 3: “Beware The Promoters”

Bitcoin and other electronic platforms have paved the way psychologically for a shift away from cash, although they have done so by emphasising decentralisation and anonymity rather than the much greater central control which would be inherent in a mainstream electronic currency. Despite the loss of privacy, electronic currency is much favoured by techno-optimists, but not so much by those concerned about the risks of absolute structural dependency on technological complexity.

Beware the dangers of a cashless society

As the country celebrates tradition and prepares for change, one major shift is closer than ever – our move towards becoming a cashless society. It is hard to imagine money without the Queen’s profile proudly embossed, defining our Elizabethan generation in a centuries-old British tradition, but the monarch’s face is fast disappearing from our pockets.

War On Cash Gathers Momentum – Germany Unveils Cash Controls

On Monday (1 February, 2016) just two days ago, Bloomberg called on the central banks of the world to “bring on a cashless future” in an Op-Ed that calls notes and coins “dirty, dangerous, unwieldy, and expensive.”

We can imagine it would be quite easy to harm someone by firing large coins at them from a gun and terrorists could probably stuff an improvised explosive device with small coins rather than nails or nuts and bolts. And if …

The Financial Times Calls for Ending Cash, Calls it a “Barbarous Relic”

Earlier this week, as the financial world was in turmoil following a rapid crash and recovery in financial markets. While we the punters shook our heads and wondered how the banksters get away with this kind of shit, The Financial Times published a dastardly little piece of fascist New World Order propaganda.

[ Free Speech Murdered ] … [ Free Speech catalogue ] … [ death of democracy ] … [ Cashless society ]

It was deeply disturbing that Nigel Farage was debanked by Coutts for his political and social attitudes but becomes truly sinister when we consider that apparently no other bank was prepared to offer him an account and they all marched in lockstep (goose step?) with Coutts.

If he could have easily moved to another bank it would have been shameful that Coutts, the bank that discriminates on the basis of wealth. also discriminates on the basis of politics, while being quite happy to offer services to some of the world’s most brutal authoritarian tyrants, a number of very unsavoury east European oligarchs and authocratic leaders of Arab oil states in which the concept of human rights simply does not exist, but the fact that other banks took a similar stance becomes a matter of totalitarian oppression.

Because of the nature of their business banks should not be able to select their customers on the basis of political positions just as they cannot discriminate on grounds of race, religion, skin colour or sexual orientation. Coutts was wrong to kick NF out for the reasons set out in the report and the other banks should not have been able to so glibly refuse his custom without a sound reason for doing so